Fund Manager

The LCP Group

The LCP Group

Fund Manager

Primary Strategy: Real Estate

Year Founded: 1974

Number of Employees: 31

Ownership: Partnership

Year End: December

Description

The LCP Group: The LCP Group, L.P. is a pioneer in real estate investments with over $850 million in assets under management and has executed more than $12 billion in transactions. It attracts global investors through high-yield projects, owning hospitality and diverse properties worth about $350 million. Their EB-5 program funds job-creating projects, aiding U.S. residency for foreign investors.

Address

50 Main Street, Suite 1410, White Plains, New York, United States

Date

As of: October 31, 2025

Key Metrics

See data over time{{ metric.value.toLocaleString() }}

{{ metric.details.label }}

{{ metric.details.desc }}Office Locations

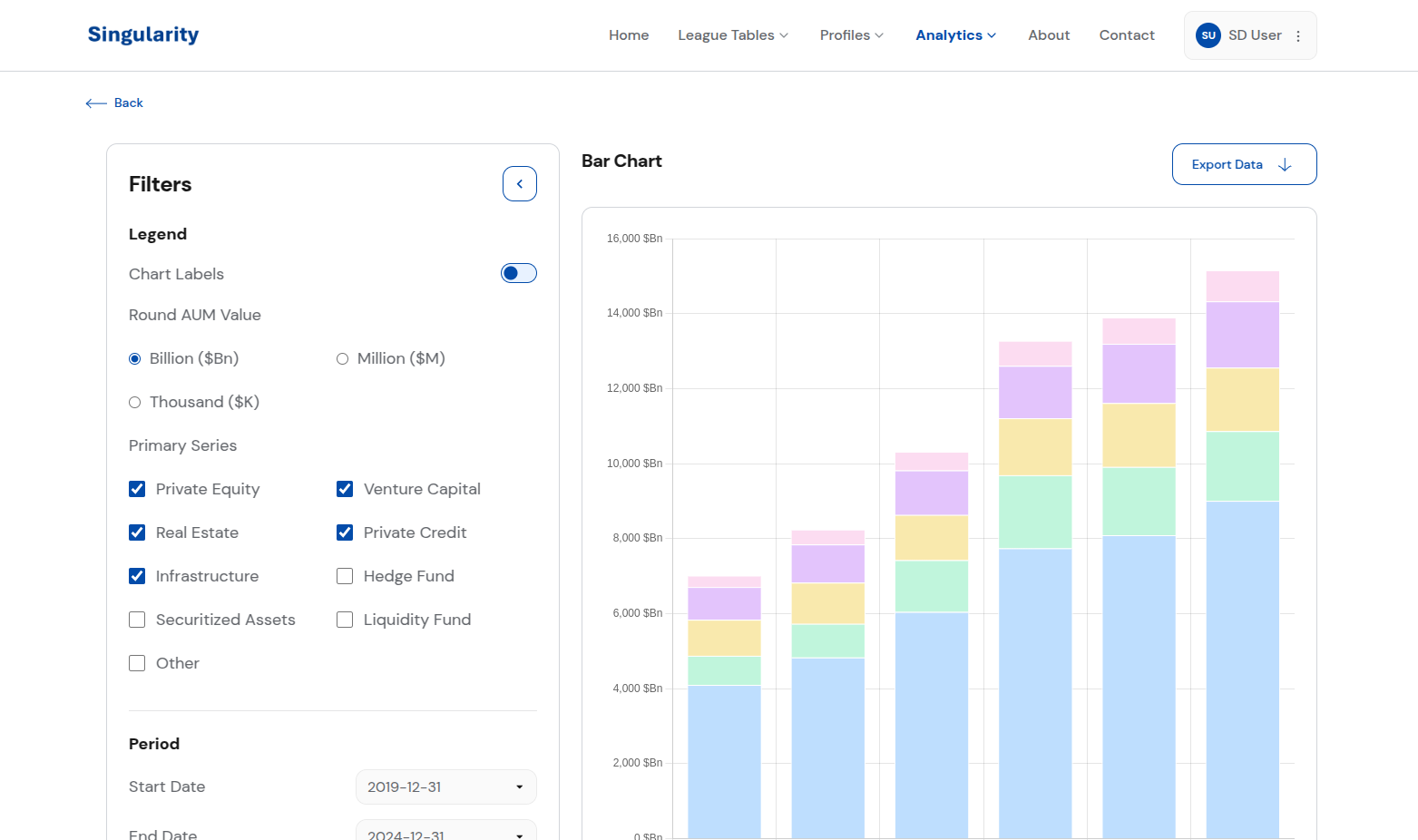

Business mix

Mix of Private Fund AUM ($M)

By geography

By strategy

By fund size

By fund vintage

Leadership and Fund Service Providers

Key Management

{{ leader.name }}

{{ leader.value ?? '-' }}

Fund Service Providers

Key Metrics

Table view

No matching search results

We couldn't find any results for your search. Please check your spelling or try using different keywords. Please Try Again

| {{ heading }} |

|---|

|

{{ cell.label }}

{{ cell.desc }}

{{ typeof(cell) === 'number' ? cell.toLocaleString() : cell }}

{{ '-' }}

|

Key Metrics

Chart view

No matching search results

We couldn't find any results for your search. Please check your spelling or try using different keywords. Please Try Again

Top {{ pagination.total }} {{ pagination.total === 1 ? 'Fund' : 'Funds' }}

Top fund structures by AUM

No matching search results

We couldn't find any results for your search. Please check your spelling or try using different keywords. Please Try Again

| {{ heading.label }} {{ heading.desc }} |

|---|

|

{{ cell }}

|

Current Service Providers

Fund Administrators

No matching search results

We couldn't find any results for your search. Please check your spelling or try using different keywords. Please Try Again

| {{ heading.label }} {{ heading.desc }} |

|---|

|

{{ cell }}

|

Fund Auditors

No matching search results

We couldn't find any results for your search. Please check your spelling or try using different keywords. Please Try Again

| {{ heading.label }} {{ heading.desc }} |

|---|

|

{{ cell }}

|

Switches

Last 12 months

No matching search results

We couldn't find any results for your search. Please check your spelling or try using different keywords. Please Try Again

| {{ heading.label }} {{ heading.desc }} |

|---|

|

{{ cell }}

|

Team

Individuals

No matching search results

We couldn't find any results for your search. Please check your spelling or try using different keywords. Please Try Again

| Number | {{ heading.label }} {{ heading.desc }} |

|---|---|

| {{ (pagination.currentPage - 1) * pagination.perPage + rowIndex + 1 }} |

{{ cell }}

|

Questions relating to our data?

Singularity is a subscription-based data platform with data on the private fund industry. Contact us with any questions about this profile or for a demo of our full platform.

Contact Us