Fund Manager

Nexus Venture Partners

Nexus Venture Partners

Fund Manager

Primary Strategy: Venture Capital

Year End: December

Description

Nexus Venture Partners is a venture capital firm that supports founders in building product-first companies. With $2.6 billion under management, Nexus focuses on enterprise software in the US and digitally-enabled businesses in India. They are involved from inception to Series A and actively engage with companies such as Postman, Delhivery, and Unacademy.

Address

Iq Eq Fund Services (Mauritius) Ltd, 33, Edith Cavell Street, Port Louis, Port Louis, California, Mauritius

Date

As of: October 31, 2025

Key Metrics

See data over time{{ metric.value.toLocaleString() }}

{{ metric.details.label }}

{{ metric.details.desc }}Office Locations

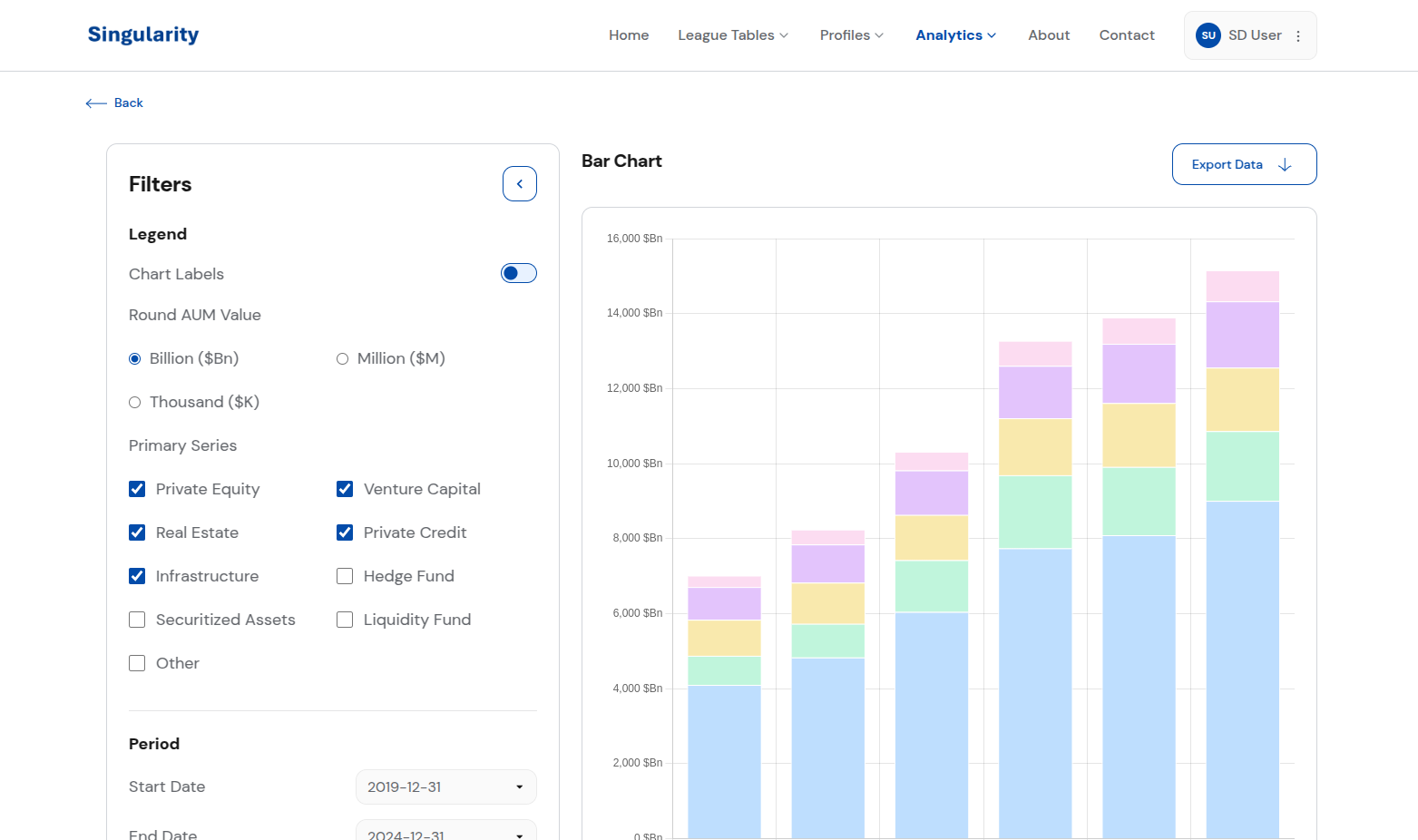

Business mix

Mix of Private Fund AUM ($M)

By geography

By strategy

By fund size

By fund vintage

Leadership and Fund Service Providers

Key Management

{{ leader.name }}

{{ leader.value ?? '-' }}

Fund Service Providers

Key Metrics

Table view

No matching search results

We couldn't find any results for your search. Please check your spelling or try using different keywords. Please Try Again

| {{ heading }} |

|---|

|

{{ cell.label }}

{{ cell.desc }}

{{ typeof(cell) === 'number' ? cell.toLocaleString() : cell }}

{{ '-' }}

|

Key Metrics

Chart view

No matching search results

We couldn't find any results for your search. Please check your spelling or try using different keywords. Please Try Again

Top {{ pagination.total }} {{ pagination.total === 1 ? 'Fund' : 'Funds' }}

Top fund structures by AUM

No matching search results

We couldn't find any results for your search. Please check your spelling or try using different keywords. Please Try Again

| {{ heading.label }} {{ heading.desc }} |

|---|

|

{{ cell }}

|

Current Service Providers

Fund Administrators

No matching search results

We couldn't find any results for your search. Please check your spelling or try using different keywords. Please Try Again

| {{ heading.label }} {{ heading.desc }} |

|---|

|

{{ cell }}

|

Fund Auditors

No matching search results

We couldn't find any results for your search. Please check your spelling or try using different keywords. Please Try Again

| {{ heading.label }} {{ heading.desc }} |

|---|

|

{{ cell }}

|

Switches

Last 12 months

No matching search results

We couldn't find any results for your search. Please check your spelling or try using different keywords. Please Try Again

| {{ heading.label }} {{ heading.desc }} |

|---|

|

{{ cell }}

|

Questions relating to our data?

Singularity is a subscription-based data platform with data on the private fund industry. Contact us with any questions about this profile or for a demo of our full platform.

Contact Us